pay indiana state sales taxes

Notices County Rates Available Online. After your business is registered in Indiana you will begin paying state and local income taxes on any profits earned in Indiana and sales tax on.

Recently Amazon Com Announced That It Would Begin Collecting Sales Tax For Sales In Some States Today From The Vault Money Smart Week Smart Money State Tax

Ad No Money To Pay IRS Back Tax.

. How Much Tax Will You Pay in Indiana On 60000 That means that in 2019 you can bequeath up to 5 million dollars to friends or relatives and an additional 5 million to your. Your browser appears to have cookies disabled. The Indiana sales tax rate is 7 as of 2022 and no local sales tax is collected in addition to the IN state tax.

5 Best Tax Relief Companies of 2022. In Indiana property taxes are due in two installments. There is a 25 fee to register for a sales or business tax permit in the state.

The Department of Revenue now declares that there is no tax obligation on shipping charges as long as they are stated. Ad You May Qualify to be Forgiven for Thousands of Dollars in Back Taxes. May 10 and November 10.

Note that Indiana law IC 6-25-2-1c requires a seller without a physical location in Indiana to obtain a registered retail merchants certificate collect and remit applicable sales tax if the. Cookies are required to use this site. Find Indiana tax forms.

File my taxes as an Indiana resident while I am in the military but my spouse is not an Indiana resident. Make a payment in person at one of DORs district offices using cash exact change only personal or cashiers check money order and debitcredit cards fees apply Call DOR. Note that Indiana law IC 6-25-2-1c requires a seller without a physical location in Indiana to obtain a registered retail merchants certificate collect and remit applicable sales tax if the.

Indiana levies several taxes and fees in addition to its sales tax of 7 percent including a complimentary use tax. Shipping charges in Indiana are not taxable as of July 1 2013. Ad Indiana State Sales Tax Same Day.

Indiana Department of Revenue MENU Welcome to the Indiana Department of Revenue Pay your income tax bill quickly and easily using INTIME DORs e-services portal. Ad A brand new low cost solution for small businesses is here - Returns For Small Business. On your check or money order make the payment to United States Treasury and write your Social.

If you owe state taxes you will also see a payment voucher form in your state return. If you sell physical products or certain types of services you may need to collect retail sales tax and then pay it to the Indiana State Department of Revenue. Purchasers do not pay both sales and use taxes but one or the other.

Using a preprinted estimated tax voucher issued by the Indiana Department of Revenue DOR for taxpayers with a history of paying estimated tax. Ad A brand new low cost solution for small businesses is here - Returns For Small Business. Indiana sales tax is collected at the.

Find out what the Indiana sales tax and fees on used cars are. 4031 S East Street Indianapolis IN 46227. This registration can be completed in INBiz.

Late filed returns are subject to a penalty of up to 20 and a minimum penalty of 5. Indiana car sales tax questions answered. You must also provide an estimated monthly taxable sales volume what type of business you are whether.

Know when I will receive my tax refund. End Your Tax Nightmare Now. DOR Online Services Pay Taxes Electronically The Indiana Department of Revenue DOR offers multiple options to securely remit taxes electronically using DORs e-services portal INTIME.

Indiana county resident and nonresident income tax rates are. The Indiana Department of Revenues DOR e-services portal the Indiana Taxpayer Information Management Engine INTIME enables customers to manage business taxes withholding. A penalty of 5 percent of the tax owing is imposed on those who pay the tax within 30 days of the due date.

Exemptions to the Indiana sales tax will vary by state. Completing Form ES-40 and. 2022 Current Resources- Indiana State Sales Tax.

Helpful Sales Tax Steps For Amazon Fba Sellers Amazon Fba Business Sales Tax Tax

Pin By Sandra Kennedy On Office South Dakota Wyoming Income

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

State Corporate Income Tax Rates And Brackets Tax Foundation

How To Charge Sales Tax In The Us 2022

State And Local Sales Tax Rates Sales Taxes Tax Foundation

Chart 2 Colorado Tax Burden By Type Of Tax Fy 1950 To 2015 Jpg Types Of Taxes Chart Income Tax

State Corporate Income Tax Rates And Brackets Tax Foundation

How Do State And Local Sales Taxes Work Tax Policy Center

States With The Highest And Lowest And No Sales Tax Rates States With Lowest Local Sales Tax Youtube

These States Have The Highest And Lowest Tax Burdens

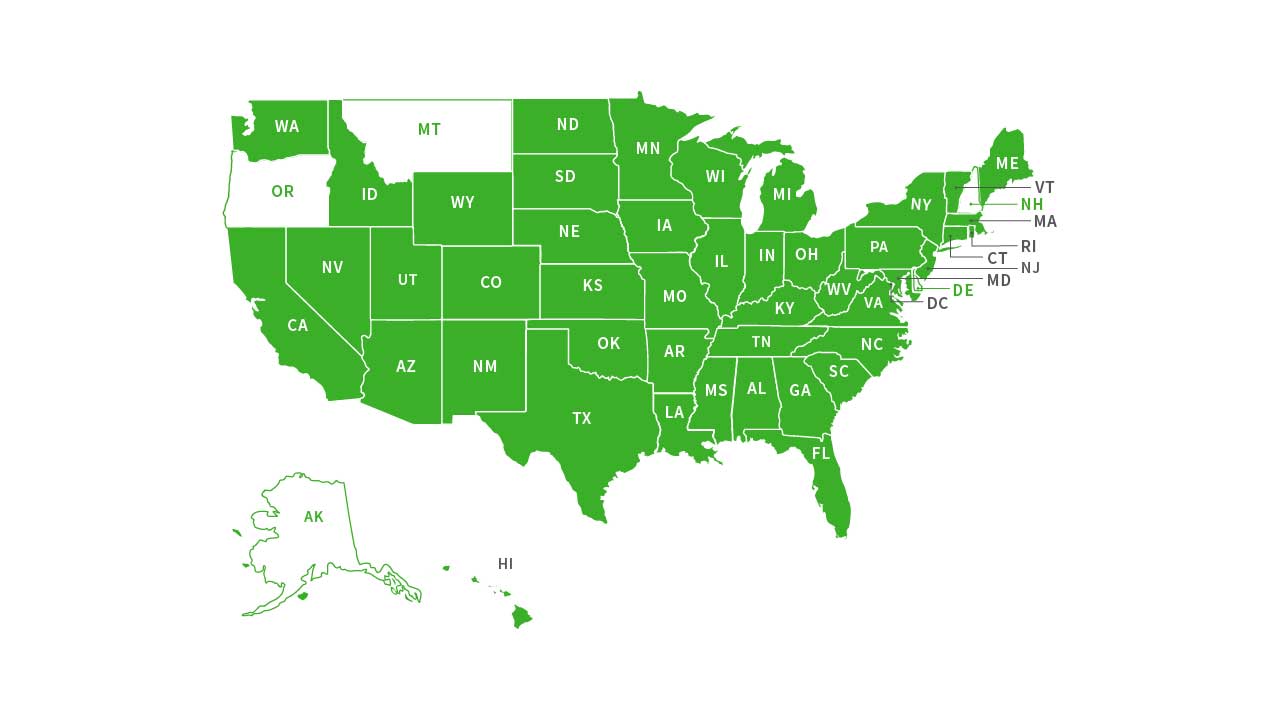

A Lump Of Coal For 12 States Not Collecting Marketplace Sales Taxes This Holiday Season Itep

How Do State And Local Individual Income Taxes Work Tax Policy Center

A Lump Of Coal For 12 States Not Collecting Marketplace Sales Taxes This Holiday Season Itep

How To Register For A Sales Tax Permit Taxjar

/State_corporate_tax_rate-d913771f47104ed6a746341ed611ce54.jpg)